MYOB South Asia • www.myob.com.my Copyright AZAM ACCOUNTING SERVICES (NF 0895) . All Rights Reserved

Easy to set up and use

> Easy Setup Assistant ensures you're up and running

quickly

> Use and intuitive Command Centre to easily navigate

your accounts, banking, sales and contacts

Easily manage your inventory

> Keep track of what you buy and sell, and how much

you have on hand

> Raise purchase orders and automatically back order

inventory items

Simplify GST calculations

> Easily calculate and track your GST

>Automatically generate your GST and know at a glance

where you're at with your GST Submission

> Easily prepare your GST monthly or quarterly submission to the Royal Malaysian Customs Department (RMCD).

Note : ABSS Accounting has been approved by Royal

Customs Malaysia for Government Subsidy.

Only claimable by SMEs who are GST registered.

Manage sales and purchases

> Produce professional quotes and invoices for items

and services

> Email purchase orders, quotes, invoices and

remittance advices to customers and suppliers

> Easily track what’s owed to you and when you should

be paid

Quickly view your financial position

> View the following financial indicators and more at a

glance:

• Profitability

• Customer analysis (eg outstanding and o verdue

receivables)

• Account details (bank acc ount, credit card balances

and more)

Effectively manage your customers

> Synchronise your contacts with Microsoft Outlook®

> Keep track of all your customer interactions using the

contact log

Customise your reports and business forms

> Design the layout of your invoices, statements and

receipts to fit your business and its professional image

> Quickly add and remove data then save as

customised reports

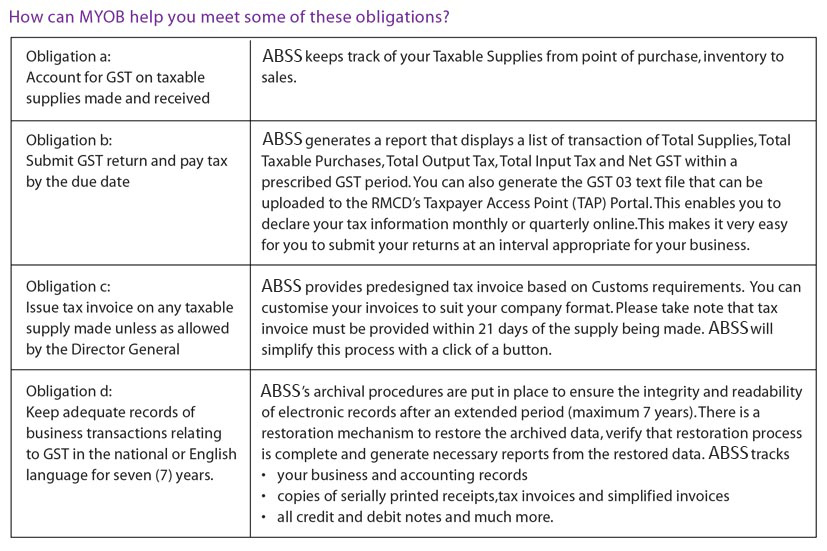

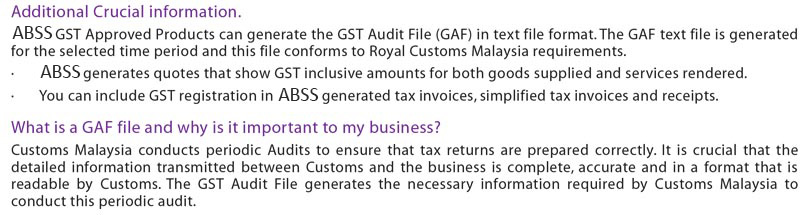

How can ABSS help you meet your GST obligations?

What are some of the Obligations of a Taxable Business?

a. Account for GST on taxable supplies made

and received

b. Submit GST return and pay tax by the due da te

c. Issue tax invoice on any taxable supply made unless as

allowed by the Director General

d. Keep adequate records of business transactions relating to

GST in the national or English language for seven (7) years.

..............................................................................................................................................................................................................................................................................

Get ABSS Softwares Quotation Request form.